1675 Broadway, Suite 3002600

Denver, CO 80202

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

to be held December 15, 2015May 18, 2018

Dear Shareholder:

You are cordially invited to attend the 20152018 annual meeting of shareholders of Synergy Resources CorporationSRC Energy Inc. (the “Company”), which will be held on December 15, 2015,May 18, 2018, at 10:9:00 a.m., Mountain Daylight Time, at the WestinSheraton Denver Downtown Hotel, 1672 Lawrence St.,1550 Court Place, Denver, Colorado 80202, for the following purposes:

| 1. | To elect the nominees named in the accompanying proxy statement as members of the Company’s |

| 2. | To |

| 3. | To approve an amendment of the Company’s 2015 Equity Incentive Plan to, among other things, increase the maximum number of shares of common stock of the Company that may be issued pursuant to awards under the 2015 Equity Incentive Plan; |

| 4. | To approve a non-binding, advisory vote on executive compensation; |

| 5. | To |

| 6. | To ratify the |

| To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

All shareholders are invited to attend the meeting. Shareholders of record at the close of business on October 19, 2015,March 23, 2018, the record date fixed by the Board of Directors, are entitled to notice of and to vote at the meeting. You must present your proxy, voter instruction card, or meeting notice for admission.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders To Be Held on December 15, 2015.May 18, 2018. The proxy statementmaterials for the annual meeting isare available electronically at http://www.viewproxy.com/syrginfo/2016.

materials.proxyvote.com/78470V.

The Board of Directors recommends that shareholders vote for each proposal. Whether or not you intend to be present at the meeting, please sign and date the enclosed proxy and return it in the enclosed envelope, or vote by telephone or online following the instructions on the proxy.

On behalf of the Board of Directors, we would like to express our appreciation for your continued support of Synergy Resources Corporation.

the Company.

By Order of the Board of Directors

Very truly yours,

| /s/ Lynn A. Peterson | ||||

| Chief Executive Officer | ||||

TABLE OF CONTENTS

Page

PROXY STATEMENT FOR THE 2015

2018 ANNUAL MEETING OF SHAREHOLDERS

2018 ANNUAL MEETING OF SHAREHOLDERS

These proxy materials are being furnished to you by the Board of Directors (the “Board”) of Synergy Resources Corporation,SRC Energy Inc., a Colorado corporation (“we,” “us,” “Synergy”“us” or the “Company”), in connection with its solicitation of proxies for Synergy’sthe Company’s Annual Meeting of Shareholders to be held on December 15, 2015May 18, 2018, at 10:9:00 a.m., Mountain Daylight Time, at the WestinSheraton Denver Downtown Hotel, 1672 Lawrence St.,1550 Court Place, Denver, Colorado 80202, and at any adjournments or postponements thereof (the “Annual Meeting”). In addition to solicitation by mail, certain of our directors, officers and employees may solicit proxies by telephone, personal contact, or other means of communication. They will not receive any additional compensation for these activities. We have entered into an agreement with Alliance Advisors, LLC to provide proxy soliciting services, and we anticipate paying approximately $8,000 for such services. Also, brokers, banks and other persons holding common stock on behalf of beneficial owners will be requested to solicit proxies or authorizations from beneficial owners. We will bear all costs incurred in connection with the preparation, assembly and mailing of the proxy materials and the solicitation of proxies and will reimburse brokers, banks and other nominees, fiduciaries and custodians for reasonable expenses incurred by them in forwarding proxy materials to beneficial owners of our common stock.

This proxy statement and the enclosed proxy card are expected to be first sent to our shareholders on or about November 9, 2015.April 2, 2018. The proxy materials are also available at http://www.viewproxy.com/syrginfo/2016.materials.proxyvote.com/78470V.

All valid proxies properly executed and received by the Company prior to the Annual Meeting will be voted in accordance with the instructions specified in such proxies. Where no instructions are given, shares will be voted “FOR” the election of the director nominees named herein (Proposal No. 1), “FOR” the ratificationapproval of EKS&H LLLP asan amendment of the Company’s independent registered accounting firm for the fiscal year ending August 31, 2016 (Proposal No. 2), “FOR” the approval of the Synergy Resources Corporation 2015 Equity Incentive Plan (Proposal No. 3), “FOR” the amendment of theSecond Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock of the Company (Proposal No. 2), “FOR” the approval of an amendment of the Company’s 2015 Equity Incentive Plan to, among other things, increase the maximum number of shares of common stock of the Company that may be issued pursuant to awards under the 2015 Equity Incentive Plan (Proposal No. 3), “FOR” the non-binding, advisory vote on executive compensation (Proposal No. 4), and “FOR”every “1 Year” for the proposal to approve,non-binding, advisory vote on anthe frequency of advisory basis, ourvotes on executive compensation (Proposal No. 5), and “FOR” the ratification of Deloitte & Touche LLP as the Company’s independent registered accounting firm for the fiscal year ending December 31, 2018 (Proposal No. 6).

A shareholder giving the enclosed proxy has the power to revoke it at any time before it is exercised by affirmatively electing to vote in person at the meetingAnnual Meeting or by delivering to the Company’s corporate secretary either an instrument of revocation or an executed proxy bearing a later date.

On February 25, 2016, the Board approved a change of our fiscal year from August 31 to December 31, commencing with the twelve-month period beginning on January 1, 2016. Certain disclosures in this Proxy Statement cover the four-month transition period from September 1, 2015 to December 31, 2015 (the “Transition Period”).

QUESTIONS AND ANSWERS ABOUT THE

ANNUAL MEETING AND PROCEDURAL MATTERS

ANNUAL MEETING AND PROCEDURAL MATTERS

Why am I receiving these proxy materials?

The Board is providing these proxy materials to you in connection with the solicitation of proxies for use at the Annual Meeting to be held December 15, 2015May 18, 2018 at 10:9:00 a.m., Mountain Daylight Time, for the purposes of considering and acting upon the matters set forth in this Proxy Statement.

What is the purpose of the meeting?Annual Meeting?

The purpose of the meetingAnnual Meeting is to vote on the following matters:

| 1. | To elect the nominees named herein as members of the Company’s Board; |

| 2. | To |

| 3. | To approve an amendment of the Company’s 2015 Equity Incentive Plan to, among other things, increase the maximum number of shares of common stock of the Company that may be issued pursuant to awards under the 2015 Equity Incentive Plan; |

| 4. | To approve a non-binding, advisory vote on executive compensation; |

| 5. | To |

| 6. | To ratify the |

| To transact such other business as may properly come before the |

Am I entitled to vote at the meeting?Annual Meeting?

Shareholders of record on October 19, 2015,March 23, 2018, the record date for the meeting,Annual Meeting, are entitled to receive notice of and to vote at the meeting.Annual Meeting. As of the close of business on October 19, 2015,March 23, 2018, there were 105,111,133[__] outstanding shares of common stock entitled to vote at the meeting,Annual Meeting, with each share of common stock entitling the holder of record on such date to one vote.

Where is the Annual Meeting being held?

The Annual Meeting will be held at the WestinSheraton Denver Downtown Hotel, 1672 Lawrence St.,1550 Court Place, Denver, Colorado 80202.

What is the difference between holding shares as a “shareholder of record” and holding shares as “beneficial owner” (or in “street name”)?

Most shareholders are considered “beneficial owners” of their shares (sometimes also referred to as shares held in “street name”), which means that they hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Shareholder of Record: If your shares are registered directly in your name with our transfer agent, you are considered the “shareholder of record” with respect to those shares. As a shareholder of record, you have the right to grant your voting proxy directly to us by submitting your vote by mail or telephone or via the Internet, or to vote in person at the meeting.Annual Meeting. For additional information, please see “What are the different methods that I can use to vote my shares of common stock?” below.

Beneficial Owner: If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner” of shares held in “street name,” and the proxy materials are being forwarded to you by your broker, bank or nominee. As a beneficial owner, you have the right to direct your broker, bank or nominee as to how to vote your shares if you follow the instructions you receive from that firm. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote these shares in person at the meetingAnnual Meeting unless you request, complete and deliver the proper documentation provided by your broker, bank or nominee and bring it with you to the meeting.Annual Meeting.

What is a “broker non-vote”?

If you are a beneficial owner of your shares, you will receive material from your broker, bank or other nominee asking how you want to vote and informing you of the procedures to follow in order for you to vote your shares. If the nominee does not receive voting instructions from you, it may vote only on proposals that are considered “routine” matters under applicable rules. A nominee’s inability to vote because it lacks discretionary authority to do so is commonly referred to as a “broker non-vote.” For a description of the effect of broker non-votes on each proposal to be made at the Annual Meeting, see “What vote is required to approve each proposal?” below. Only Proposal No. 2, relating to an amendment of the Company’s Second Amended and Restated Articles of Incorporation, and Proposal No. 6, relating to the ratification of our independent registered audit firm, isare considered routine for the purposes of this rule.

What are the different methods that I can use to vote my shares of common stock?

Shareholder of Record: If you are a shareholder of record, there are several ways for you to vote your shares, as follows:

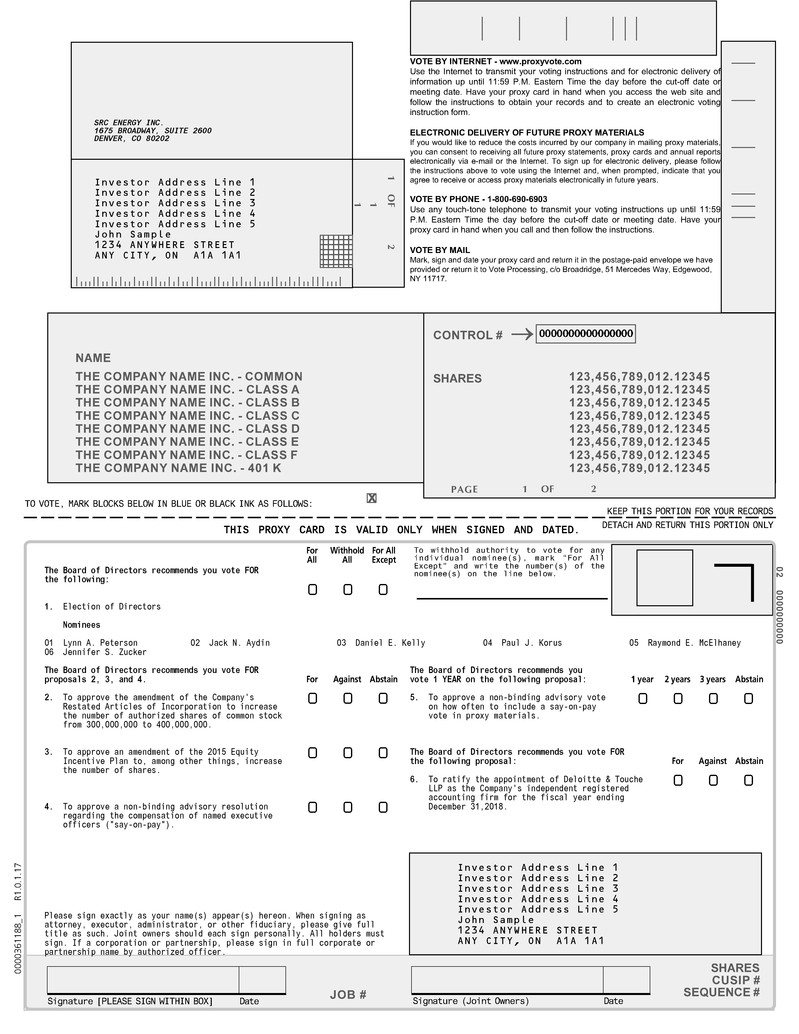

By Telephone or Via the Internet:Internet: Shareholders of record can vote their shares by telephone at (800) 690-6903 or via the Internet at www.proxyvote.com by following the instructions provided in the enclosed proxy card. Shareholders of record who vote by telephone or via the Internet need not return a proxy card by mail.

By Written Proxy:Proxy: Shareholders of record can vote their shares by marking, signing and timely returning the enclosed proxy card.

In Person:Person: All shareholders of record may vote in person at the Annual Meeting. For those planning to attend in person, we also recommend submitting a proxy card or voting by telephone or via the Internet to ensure that your vote will be counted if you later decide not to attend the meeting.

Annual Meeting.

Beneficial Owner: If you are a beneficial owner, you should have received voting instructions from your broker, bank or other nominee. Beneficial owners must follow the voting instructions provided by their nominee in order to direct such broker, bank or otherthe nominee as to how to vote their shares. The availability of telephone and Internet voting depends on the voting process of such broker, bank or nominee. Beneficial owners must obtain a legal proxy from their broker, bank or nominee prior to the Annual Meeting in order to vote in person.

What are my voting rights as a shareholder?

Shareholders are entitled to one vote for each share of our common stock that they own as of the record date.

Can I revoke or change my vote?

Yes. If you are a shareholder of record, you may revoke or change your vote before the proxy is exercised by filing with our Secretary a notice of revocation, delivering to us a new proxy, or by attending the meetingAnnual Meeting and voting in person. Shareholders of record who vote via the Internet or by telephone may change their votes by re-voting by those means. If you are a beneficial owner, you must follow instructions provided by your broker, bank or other nominee. A shareholder’s last timely vote, whether via the Internet, by telephone or by mail, is the one that will be counted.

What constitutes a quorum?

Shareholders representing one-third of the outstanding shares entitled to vote at the meeting, present in person or by proxy, will constitute a quorum for the transaction of business at the meeting.Annual Meeting. Abstentions and broker non-votes will be counted towards a quorum. At the close of business on October 19, 2015,March 23, 2018, the record date for the meeting,Annual Meeting, there were105,111,133[__] shares of our common stock outstanding.

What are the Board’s recommendations?

Our Board recommends a vote FOR each proposal set forth in this Proxy Statement.“FOR” the election of the director nominees named herein (Proposal No. 1), “FOR” the approval of an amendment of the Company’s Second Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock of the Company (Proposal No. 2), “FOR” the approval of an amendment of the Company’s 2015 Equity Incentive Plan to, among other things, increase the maximum number of shares of common stock of the Company that may be issued pursuant to awards under the 2015 Equity Incentive Plan (Proposal No. 3), “FOR” the non-binding, advisory vote on executive compensation (Proposal No. 4), every “1 Year” for the non-binding, advisory vote on the frequency of advisory votes on executive compensation (Proposal No. 5), and “FOR” the ratification of Deloitte & Touche LLP as the Company’s independent registered accounting firm for the fiscal year ending December 31, 2018 (Proposal No. 6).

If any other matters are brought before the meeting,Annual Meeting, the proxy holders will vote as recommended by our Board. If no recommendation ifis given, the proxy holders will vote in their discretion.

What vote is required to approve each proposal?

You may vote “FOR” or “WITHHOLD” authority to vote on Proposal No. 1, relating to the election of directors. Members of the Board are elected by a plurality of votes cast. This means that the ninesix nominees who receive the largest number of “FOR” votes cast will be elected. While directors are elected by a plurality of votes cast, our Board has adopted a majority voting policy which provides for majority voting for directors in uncontested elections. Under our majority voting policy, any incumbent director nominee who receives a greater number of “WITHHOLD” votes than “FOR” votes with respect to his or her election at the Annual Meeting shall tender his or her resignation promptly after the final vote. Our Board, within 90 days of receiving the certified voting results pertaining to the election, will decide whether to accept the resignation of any unsuccessful incumbent, or whether other action should be taken, through a process managed by the Nominating Committee. In reaching its decision, the Board may consider any factors it deems relevant, including the stated reasons, if any, why shareholders withheld their votes, possible alternatives for curing such underlying cause of withheld votes, the director’s tenure, the director’s qualifications, the director’s past and expected future contributions to us, the overall composition of the Board, and whether accepting the tendered resignation would cause us to fail to meet any applicable rule or regulation, including NYSE

American listing standards and Securities and Exchange Commission (“SEC”) regulations. The Board will promptly disclose the decision whether to accept the director’s resignation offer (and the reasons for rejecting the resignation, if applicable) in a document filed with the SEC. There is no cumulative voting for directors. Each other

You may vote “FOR” or “AGAINST” Proposal No. 2, or you may abstain from voting on the proposal, set forth in this Proxy Statementwhich relates to the approval of an amendment of the Company’s Second Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock of the Company from 300,000,000 to 400,000,000. Proposal No. 2 will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal.

You may vote “FOR” or “AGAINST” Proposal No. 3, or you may abstain from voting on the proposal, relating to the approval of an amendment of the Company’s 2015 Equity Incentive Plan to, among other things, increase the maximum number of shares of common stock of the Company that may be issued pursuant to awards under the 2015 Equity Incentive Plan. Proposal No. 3 will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal.

You may vote “FOR” or “AGAINST” Proposal No. 4, or you may abstain from voting on the proposal, which relates to the non-binding, advisory vote on executive compensation. Proposal No. 4 will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal, although such vote will not be binding on the Company.

You may vote for every “1 Year,” every “2 Years” or every “3 Years” on Proposal No. 5, or you may abstain from voting on the proposal, which relates to the non-binding, advisory vote on the frequency of advisory votes on executive compensation. The frequency alternative receiving the highest number of votes (a plurality of votes cast) will be considered the frequency approved by the shareholders, although such approval will not be binding on the Company.

You may vote “FOR” or “AGAINST” Proposal No. 6, or you may abstain from voting on the proposal, which relates to the ratification of Deloitte & Touche LLP as the Company’s independent registered accounting firm for the fiscal year ending December 31, 2018. Proposal No. 6 will be approved if the votes cast in favor of the proposal exceed the votes cast against the proposal.

Abstentions and broker non-votes will have no effect on the outcome of the vote on any of the proposals.

Do I have appraisal rights in connection with any of the proposals?either proposal?

No action is proposed at the Annual Meeting for which the laws of the State of Colorado or other applicable law provides a right of our shareholders to dissent and obtain appraisal of or payment for such shareholders’ common stock.

Who can help answer my questions?

If you need assistance in voting by telephone or over the Internet or completing your proxy card, or have questions regarding the Annual Meeting, please contact:

(720) 616-4300

corpsecretary@srcenergy.com

2017 PERFORMANCE SUMMARY

This proxy statement relates to the Annual Meeting. At the Annual Meeting, shareholders will be asked to vote on non-binding proposals regarding the Company’s executive compensation and the frequency of future votes on executive compensation. While these proposals are described in more detail in Proposal No. 4 and Proposal No. 5, the following provides a brief summary of certain factors the Board considers relevant to these matters.

2017 Performance Overview

Throughout 2017, SRC continued its efforts to increase shareholder value and maintain our competitiveness through operational proficiency and a strong leadership structure. Some of the key initiatives and significant accomplishments reflected in our operational and financial performance during the year include the following:

Key strategic initiatives

| o | We integrated and continued development of the 2016 acquisition of Greeley Crescent acreage (the “GCI Acquisition”); |

| o | We evaluated and pursued incremental growth opportunities, and, most importantly, closed the second significant acquisition of Greeley Crescent acreage (the “GCII Acquisition”), which added approximately 30,200 net acres and over 600 gross drilling locations adjacent to our existing leasehold; |

| o | In conjunction with the GCII Acquisition, we executed capital markets transactions that raised $312 million in equity and $550 million in long-term debt; |

| o | We maintained a strong capital structure through the use of both equity and debt financing to fund our expansion. Based on our year-end net long-term debt and our 2017 EBITDA, our ratio of net debt to EBITDA was 1.8X, which we consider to be relatively low in our industry; and * |

| o | We maintained the ability to continue our capital investment program by providing liquidity to carry out our program. We ended 2017 with $49 million in cash and a revolving credit facility with a borrowing base of $400 million and no outstanding borrowings. |

Operational results

| o | Our 2017 capital program resulted in the investment of approximately $460 million in a high-return drilling and completion program that resulted in an increase in the Company’s oil and gas production to 34.2 MBOE per day, a year over year increase of over 190% from 2016; |

| o | During 2017, we continued to operate two drilling rigs along with the related completion crews. This effort resulted in 109 operated wells turned to sales as compared to 24 in 2016. |

| o | On a debt-adjusted per-share basis, our production increased 125% from 2016, further illustrating the addition of value for the Company’s shareholders. * |

Economic returns on capital and development costs

| o | The Company’s investments resulted in a 21.0% cash return on average capital employed for 2017, and 15.6% for the cumulative three-year period ending December 31, 2017, which was accomplished while growing the Company’s enterprise value to $2.6 billion as of December 31, 2017, from $937 million as of the end of 2015; * |

| o | The Company’s properties have continued to demonstrate well-level returns substantially in excess of the cost of capital; and |

| o | Proved oil and gas reserves grew to 227 MMBOE at year-end 2017 from 93 MMBOE at year-end 2016, a 144% increase, resulting in a finding and development cost of $7.25 per BOE. * |

Total shareholder return (“TSR”)

| o | TSR has been favorable relative to our compensation peer group in a period where much of the industry has seen a significant loss in shareholder value due to the impacts of external market factors; |

| o | We ranked fourth among the twenty companies in our 2017 compensation peer group, and better than the S&P MidCap 400 Energy Index, for one-year TSR; |

| o | We ranked eighth among the sixteen companies in our 2017 compensation peer group for which there was sufficient data, and better than the S&P MidCap 400 Energy Index, for five-year TSR during the period; and |

| o | SRC’s TSR results for these periods have been achieved despite large scale asset and operational expansion and the related capital markets transactions necessary to fund this repositioning. |

Safety, Environmental and Community Stewardship

| o | During 2017, we had no recordable safety incidents related to our employees on our locations; |

| o | Our safety and environmental efforts also involve collaboration with our contractors to help ensure a safe workplace while minimizing our impact on our neighbors; |

| o | We have continued to add professional staff focused on safety and environmental matters with a strong emphasis on prevention, accountability and timely, accurate reporting; and |

| o | We value our position in the communities in which we operate. In 2017, we continued to focus on local needs through charitable giving campaigns and volunteer opportunities for our employees. |

Management, personnel and compensation practices

| o | In 2017, following a reconfiguration of our management involving a 100% replacement of our senior executive team in 2015 and 2016, we focused on further enhancing the Company’s capabilities through additions to our technical, operational, safety and corporate teams commensurate with our increase in operational scale. We also added personnel to our corporate staff to provide continued strong support to effectively capitalize on these efforts; |

| o | We refined our compensation structures in 2017, and further in 2018, to better align with our pay for performance philosophy, while emphasizing the Company’s key strategic goals, value creation, and rewarding economic decision-making. Towards that goal, |

| § | More than two-thirds of total direct compensation paid to the Company’s named executive officers is performance-based; |

| § | We have utilized performance goals to link executive compensation to achievement of corporate goals; and |

| § | Our long-term compensation is structured to align with shareholder value creation by subjecting significant portions of the long-term equity incentive awards to performance-based vesting. |

* See Appendix A for a reconciliation of non-GAAP financial measures.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

As of the date of this Proxy Statement and as permitted by the Company’s bylaws, the Board consists of ninesix directors. The Nominating Committee and the Board hashave nominated each current director, i.e., Messrs. Peterson, McElhaney, Aydin, Kelly and Korus and Ms. Zucker, for re-election to the Board forre-election. Each candidate elected will serve a one-year term, subject to such director’sperson’s earlier resignation or removal.

The appointed proxies will vote your shares in accordance with your instructions and for the election of the director nominees unless you withhold your authority to vote for one or more of them. The Board does not contemplate that any of the director nominees will become unavailable for any reason; however, if any director is unable to stand for election, the Board may reduce its size or select a substitute. Your proxy cannot otherwise be voted for a person who is not named in this Proxy Statement as a candidate for director or for a greater number of persons than the number of director nominees named. There is no cumulative voting for directors.

Executive Officers and Directors

Our executive officers as of the date of the Proxy Statement and directorsdirector candidates are listed below. Our directors are generally elected at our annual shareholders’ meeting and hold office until the next annual shareholders’ meeting or until their successors are elected and qualified. Our executive officers are appointed by the Board and serve at its discretion.

| Name | Age | Position | ||

| Lynn A. Peterson | Chief Executive Officer, President and | |||

| James P. Henderson | Executive Vice President and Chief Financial Officer | |||

| Vice President and General Counsel | ||||

| Michael J. Eberhard | 60 | Vice President and Chief | ||

| Vice President and Chief | ||||

| Director | ||||

| 77 | Director | |||

| Daniel E. | 59 | Director | ||

| Director | ||||

| Director | ||||

Lynn A. Peterson – Mr. Peterson joined Synergythe Company in May 2015.2015 and currently serves as the Chairman of the Board, Chief Executive Officer and President. He was a co-founder of Kodiak Oil & Gas Corp.Corporation (“Kodiak”), and served Kodiak as a director (2001-2014), and as its President, and Chief Executive Officer (2002-2014), and Chairman of the Board (2011-2014), until its acquisition by Whiting Petroleum Corporation in December 2014. Mr. Peterson served as a director of Whiting Petroleum Corporation from December 2014 to June 2015. Mr. Peterson has been a member of the board of directors of Denbury Resources Inc. since May of 2017. Mr. Peterson has over 3035 years of industry experience. Mr. Peterson was an independent oilman from 1986 to 2001 and served as Treasurer of Deca Energy from 1981 to 1986. He graduated from the University of Northern Colorado with a Bachelor of Science in Accounting.

James P. Henderson – Mr. Henderson joined Synergythe Company in August 2015.2015 and currently serves as Executive Vice President and Chief Financial Officer. He was the Chief Financial Officer of Kodiak from 2007 to 2014 until its acquisition by Whiting Petroleum Corporation in December 2014. Mr. Henderson has over 25 years of industry experience and holds a Bachelor’s degree in Accounting from Texas Tech University and a Master of Business Administration degree from Regis University.

Michael J. Eberhard–Mr. Eberhard joined the Company in August 2015. Mr. Eberhard has over 35 years of industry experience focused on field development optimization. Before joining the Company, he served as Completions Manager for Anadarko Petroleum’s DJ Basin program, a position he held from July 2011 to July 2015. From 1981 to 2011 he worked for Halliburton Energy Services in various sales and technical roles, including as Regional Technical Manager from May 2004 to July 2011. Mr. Eberhard graduated from Montana State University. He served on the Chief Financial OfficerSociety of Petroleum Engineers board of directors from 2012 to 2015. He has authored or co-authored several Society of Petroleum Engineers papers and a director of Global Casinos, Inc., and from 1994 to 2001 he served as Chief Financial Officer of American Educational Products, Inc. (NASDAQ: AMEP), before it was purchased by Nasco International. After his graduation from Austin College with a degree in economics and from Indiana University with an MBA in finance, he joined the Houston office of Coopers & Lybrand.industry articles. He also spent four years as the manager of internal auditholds a U.S. Patent for The Walt Disney Company.3D seismic data conversion.

Raymond E. McElhaney – Mr. McElhaney has been one of our directorsserved as a director since May 2005. Since January 2013, he has been the President of Longhorn Investments, LLC, a private financial company. From 1990 until December 2012, he was the President of MCM Capital Management Inc., a privately held financial management company. Mr. McElhaney is a seasoned executive with numerous appointments, directorships and consulting roles with both private and public companies in a variety of industries and business sectors. Mr. McElhaney has a strong background in oil and gas exploration and management and was a former officer and director of Wyoming Oil and Minerals and a director of United States Exploration, Inc., both publicly traded companies. Mr. McElhaney was a managing partner of Waco Pipeline, a natural gas gathering system. Over the course of his career, Mr. McElhaney has advised companies on M&A and equity transactions, commercial finance transactions, stock offerings, spinoffs and joint venture arrangements. Mr. McElhaney has been involved as an owner breeder of thoroughbred race horses since 1981. Mr. McElhaney received his Bachelor of Science Degree in Business Administration from the University of Northern Colorado in 1978.

the National Association of Petroleum Investment Analysts, and a past member of the Oil Analysts Group of New York and the New York Society of Security Analysts. Mr. Aydin holds an M.B.A. degree in finance and economics, as well as a Bachelor of Science degree in Business Administration, from Fairleigh Dickinson University in New Jersey, and a Bachelor of Science degree in Philosophy from St. Ephraim College in Mosul, Iraq.

Daniel E. Kelly – Mr. Kelly has been one of our directors since February 2016. Mr. Kelly is currently President and director of Santa Rita Resources LLC. Mr. Kelly retired from Noble Energy, Inc. in March 2015, where he served as Vice President of Regional Strategy and Planning from June 2014 to March 2015. In that role, he focused on governmental and industry relations and community engagement in the DJ Basin, and served on Governor Hickenlooper’s task force on oil and gas development issues. He served as Noble’s Vice President of Operations for the DJ Basin from June 2008 to May 2014, and as a Business Unit Manager in the DJ Basin for Noble from January 2006 to May 2008. Prior to that, he served in various engineering, operational and management roles for Noble and other oil and gas companies beginning in 1982. He holds a B.S. in Petroleum Engineering from the Colorado School of Mines.

Paul J. Korus – Mr. Korus has been one of our directors since June 2016. Mr. Korus was the Senior Vice President and Chief Financial Officer of Cimarex Energy Co. from September 2002 until his retirement in 2015, and held the same positions with its predecessor, Key Production Company, from 1999 through 2002. His previous experience also includes approximately five years as an oil and gas research analyst at an investment banking firm. He began his oil and gas career in 1982 with Apache Corporation where he held positions in corporate planning, information technology and investor relations. Mr. Korus graduated from the University of North Dakota (“UND”) with a Bachelor of Science in Economics, and also earned a Master of Science in Accounting there. Mr. Korus is a former CPA. Since 2011, Mr. Korus has served on the UND College of Business and Public Administration Alumni Advisory Council and is currently its chairperson.

Jennifer S. Zucker – Ms. Zucker has been one of our directors since January 2018. Ms. Zucker is an attorney with the law firm Greenberg Traurig, LLP in Washington D.C., which she joined as a shareholder in the Government Contracts & Projects Practice in January 2018. Her legal practice focuses on the defense sector and intelligence community. She was a partner at the Washington D.C. law firm of Wiley Rein LLP from October 2010 to January 2018, and a partner at the law firm of Patton Boggs, LLP from 2005 to 2010. Ms. Zucker has served in the U.S. Army, Judge Advocate General’s Corps and currently serves as a Colonel in the U.S. Army Reserve, where she commands the 13th Legal Operations Detachment – Expert, and was recently selected to the 2018 DirectWomen Board Institute class.

We believe Messrs. Holloway, Scaff, Peterson, McElhaney, ConradKelly and SewardKorus are qualified to act as directors due to their experience in the oil and gas industry. We believe Messrs. Wilber, NoffsingerKorus and Aydin are qualified to act as directors as result ofdue to their experience in financial matters. We believe Ms. Zucker is qualified to act as a director due to her legal and leadership experience.

CORPORATE GOVERNANCE

Board Leadership Structure and Risk Management

Our business is managed under the direction of the Board. None of our directors has been formally designatedBoard, with Mr. Peterson acting as Chairman of the Board; instead, our Co-Chief Executive Officers jointly preside over meetings of the Board and otherwise perform the duties of Chairman. NoneAlthough at present none of our independent directors has been formally designated as the lead independent director.director, we anticipate naming a lead independent director after the Annual Meeting. We do not have a policy regarding separation of the CEO and Chairman positions. We believe this structure is appropriate at this time in light of the role our Co-Chief Executive Officers have played in our historysize of the Board and development and their joint leadership roles.the Company.

In performing its duties, the Board oversees the Company’s identification and management of its critical business risks. Risks are considered on a continuous basis, including in connection with acquisition and hedging activities.

The Board meets regularly to review significant developments affecting us and to act on matters requiring its approval. Directors are requested to make attendance at meetings of the Board and Board committees a priority, to come to meetings prepared, having read any materials provided to them prior to the meetings and to participate actively in the meetings. The Board held 4nine meetings in the year ended AugustDecember 31, 20152017 and acted 37four times by written consent, primarily with respect to minor matters. All directorsconsent. No director attended allfewer than 75% of the committee meetings forof the Board (and any committees on which they served during fiscal 2015,thereof) that he or she was requested to attend, either in person or via telephone conference. All directors attended all of the Board meetings, except that one director was absent for a single meeting. Directors are not required to attend the annual shareholders'shareholders’ meeting; however, all directors are expected to attend the December 15, 2015 meeting. Seven of the eight directors then in office attended the 2017 annual meeting held on January 21, 2015.June 15, 2017.

Board Committees

The current composition and the primary responsibilities of the Audit Committee, the Compensation Committee and the Nominating Committee are described below.

The Audit Committee, established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), currently consists of Messrs. Conrad,Korus, McElhaney and Noffsinger,Aydin, with Mr. NoffsingerKorus acting as Chairman. The primary function of the Audit Committee is to assist the Board in its oversight of our financial reporting process. Among other things, the committee is responsible for reviewing and selecting our independent registered public accounting firm and reviewing our accounting practices. The Board has adopted a written charter for the Audit Committee, a copy of which can be found on the Company’s website at: www.srcenergy.com. The Board has determined that Mr. NoffsingerKorus qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of SEC Regulation S-K and that each member of the committee is independent under applicable NYSE MKTAmerican and SEC rules. During the year ended AugustDecember 31, 2015,2017, the Audit Committee held 6 six meetings.

The Compensation Committee currently consists of Messrs. Wilber,Aydin, McElhaney Conrad and Noffsinger,Kelly, with Mr. ConradAydin acting as Chairman. The Compensation Committee’s primary function is to evaluate and approve the Company’s compensation plans and programs for officers, including our Co-ChiefChief Executive Officers.Officer. The Company’s Board of Directors has adopted a written charter for the Compensation Committee, a copy of which can be found on the Company’s website at: www.syrginfo.comwww.srcenergy.com. The Board has determined that each member of the committee is independent under applicable NYSE MKTAmerican rules. During the year ended AugustDecember 31, 2015,2017, the Compensation Committee held 3 meetings. six meetings and acted once by written consent.

The Nominating Committee currently consists of Messrs. Wilber, McElhaney, Conrad, NoffsingerAydin and Aydin,Kelly, with Mr. WilberMcElhaney acting as Chairman. The Nominating Committee’s primary functions are to identify, evaluate and recommend

to the Board qualified candidates for election or appointment to the Board. The Board has adopted a written charter for the Nominating Committee, does not have a written charter.copy of which can be found on the Company’s website at: www.srcenergy.com.The Board has determined that each member of the committee is independent under applicable NYSE MKTAmerican rules. During the year ended AugustDecember 31, 2015,2017, the Nominating Committee held held no mtwoeetings. meetings and acted once by written consent.

The Company does not have a formal policy regarding the consideration of director candidates recommended by shareholders; however, the Nominating Committee will consider candidates recommended by shareholders on the same basis as candidates proposed by other persons. The Board believes that its process for assessing director candidates is appropriate at this time. Under Colorado law, any shareholder can nominate an individual as a director candidate at the annual shareholders’ meeting. To submit a candidate for the Board, a shareholder should send the name, address and telephone number of the candidate, together with any relevant background or biographical information, to the Company’s co-ChiefChief Executive OfficersOfficer at 16251675 Broadway, Suite 300,2600, Denver, Colorado 80202.

The Board has not established any specific qualifications or skills a nominee must meet to serve as a director.

Qualifications for consideration as a nominee may vary according to the particular area of expertise being sought as a complement to the existing Board composition. However, in making its nominations, the Nominating Committee considers, among other things, an individual’s business experience, industry experience, financial background, breadth of knowledge about issues affecting our business, time available for meetings and consultation, integrity, independence, diversity of experience, leadership and relevant skills. The Nominating Committee does not have a formal policy with respect to the consideration of diversity when assessing directors and directorial candidates, but considers diversity as part of its overall assessment of the Board’s functioning and needs. The committee may retain a search firm to assist it in identifying potential candidates, but it has not done so to date.

Compensation Committee Interlocks and Insider Participation

We had no compensation committee interlocks with any other company during the fiscal year ended AugustDecember 31, 2015.2017.

Director Independence

The Board has determined that each of Messrs. Wilber, McElhaney, Conrad, NoffsingerAydin, Kelly and AydinKorus and Ms. Zucker is independent under NYSE MKTAmerican rules.

Security Holder Communications Policy

Holders of the Company’s common stock can send written communications to the Company’s entire Board, of Directors, or to one or more Board members, by addressing the communication to “the Board of Directors” or to one or more directors, specifying the director or directors by name, and sending the communication to the Company’s offices at 16251675 Broadway, Suite 300,2600, Denver, Colorado 80202. Communications addressed to the Board as a whole will be delivered to each Board member. Communications addressed to a specific director (or directors) will be delivered to the director (or directors) specified. Security holder

communications not sent to either the Board as a whole or to specified Board members may not be relayed to Board members.

Code of Ethics

In connection with its oversight of our operations and governance, the Board has adopted, among other things, a Code of Business Conduct and Ethics to provide guidance to directors, officers and employees with regard to certain ethical and compliance issues and charters of the Audit Committee, the Compensation Committee and the CompensationNominating Committee of the Board. Each of these documents can be viewed on our website at www.syrginfo.comwww.srcenergy.com under the heading “Investor Relations” and the subheading “Corporate Governance.” We will disclose on our website any amendment or waiver of the Code of Business Conduct and Ethics in the manner required by SEC and NYSE MKTAmerican rules. Copies of the foregoing documents and disclosures are available without charge to any person who requests them. Requests should be directed to Synergy Resources Corporation,SRC Energy Inc., Attn: Secretary, 16251675 Broadway, Suite 300,2600, Denver, Colorado 80202.

Director Compensation

For 2017, the Company’s directors determined not to make any significant changes to the overall level of compensation for the Company's directors:Company’s non-employee directors from the amounts approved in 2015. However, starting in July 2017, the Company adjusted the timing for Board compensation from a calendar year cycle to an annual cycle beginning with the quarter following the directors’ election (or reelection) to the Board at the annual meeting (i.e., July 1). Key elements of the non-employee directors’ compensation are the following:

The Chairman of the Audit Committee receives an additional $17,000 per year, and other members of the Audit Committee receive an additional $10,000 per year.

The Chairman of the Compensation Committee receives $15,000 per year and other members of the Compensation Committee receive an additional $5,000 per year.

The Chairman of the Nominating Committee receives an additional $10,000 per year and other members of the Nominating Committee receive an additional $5,000 per year.

Fees and retainers may be paid in either cash or shares of the Company's common stock at the election of the director.

The following table shows the compensation paid or accruedduring 2017 to our Directorsnon-employee directors. Because of the change in the timing of the annual equity awards detailed above, the amounts below include equity grants for the two quarters prior to the annual meeting, as well as the annual grant made following election/reelection to the board.

| Name | Stock Awards($)(1) | Annual Retainer($) | Committee Retainers($) | Committee Chairman Retainer($) | Total($) |

Rick Wilber(2) | 73,369 | 15,000 | 2,500 | -- | 90,869 |

| Raymond McElhaney | 227,257 | 60,000 | 13,750 | 10,000 | 311,007 |

Jack Aydin | 227,257 | 60,000 | 13,750 | 15,000 | 316,007 |

| Daniel E. Kelly | 227,257 | 60,000 | 10,000 | -- | 297,257 |

Paul Korus | 227,257 | 60,000 | -- | 17,000 | 304,257 |

| Total | 982,397 | 255,000 | 40,000 | 42,000 | 1,319,397 |

(1) On January 3, 2017, the Company awarded 4,066 restricted stock units to each of Messrs. Wilber, McElhaney, Aydin, Kelly, and Korus with a fair value, computed in accordance with ASC 718, of $36,675. On February 21, 2017, the Company awarded 4,068 restricted stock units to each of Messrs. Wilber, McElhaney, Aydin, Kelly, and Korus with a fair value, computed in accordance with ASC 718, of $36,693. On July 1, 2017, the Company awarded 22,866 restricted stock units to Messrs. McElhaney, Aydin, Kelly, and Korus with a fair value, computed in accordance with ASC 718, of $153,888. The following table illustrates the compensation that would have been paid during 2017 to our non-employee directors if the Company had not changed the timing of the annual stock grant detailed above:

| Name | Stock Awards($) | Annual Retainer($) | Committee Retainers($) | Committee Chairman Retainer($) | Total($) |

| Raymond McElhaney | 153,888 | 60,000 | 13,750 | 10,000 | 237,638 |

Jack Aydin | 153,888 | 60,000 | 13,750 | 15,000 | 242,638 |

| Daniel E. Kelly | 153,888 | 60,000 | 10,000 | -- | 223,888 |

Paul Korus | 153,888 | 60,000 | -- | 17,000 | 230,888 |

| Total | 615,552 | 240,000 | 37,500 | 42,000 | 935,052 |

(2) Mr. Wilber resigned from the Board effective March 31, 2017.

In 2016, the Board adopted Share Ownership Requirements for the Company’s non-employee directors. Required ownership for non-employee directors is three times annual board cash compensation. Qualified holdings for non-employee directors are the same types of holdings (stock owned directly and unvested time-based restricted stock units) as the qualified holdings for the Company’s executives. For purposes of the policy, the value of the shares held is measured on April 1 each year, ended August 31, 2015.as the average of the month-end closing price for the 12 months preceding the date of calculation. Non-employee directors have a five-year phase-in period in which to meet the option to receive their fees in either cash or stock:

| Fees Earned or Paid in Cash | ||||||||||||||||

| Name | Annual Retainer | Committee Retainers | Committee Chairman Retainer | Total | ||||||||||||

Rick Wilber 1 | $ | 120,000 | $ | 8,000 | $ | 2,000 | $ | 130,000 | ||||||||

| Raymond McElhaney | 120,000 | 16,000 | — | 136,000 | ||||||||||||

Bill Conrad 2 | 120,000 | 16,000 | 2,000 | 138,000 | ||||||||||||

R.W. Noffsinger 3 | 120,000 | 16,000 | 2,000 | 138,000 | ||||||||||||

George Seward 4 | 120,000 | 4,000 | 2,000 | 126,000 | ||||||||||||

Jack Aydin 5 | 120,000 | — | — | 120,000 | ||||||||||||

| Total | $ | 720,000 | $ | 60,000 | $ | 8,000 | $ | 788,000 | ||||||||

Certain Relationships and Related Person Transactions

The Board has established a practice pursuant to which it reviews, and approves and ratifies when deemed appropriate, transactions with related parties including directors and executive officers of the Company and entities in which such persons have a significant financial interest. Pursuant to this practice, any transaction between the Company and the related person(s) must be approved by a majority of the Company’s disinterested directors. In determining whether to approve or ratify a transaction, the disinterested directors will consider the relevant facts and circumstances of the transaction, which may include factors such as the relationship of the related person with the Company, the business purpose and reasonableness of the transaction, whether the transaction is comparable to a transaction that could be available to the Company onfrom an arms-length basisunrelated party and the impact of the transaction on the Company’s business and operations.

| For the years ended August 31, | ||||||||||||

| 2015 | 2014 | 2013 | ||||||||||

| Restricted shares of common stock | — | 15,883 | 31,454 | |||||||||

| Value of restricted common stock (in thousands) | $ | — | $ | 106 | $ | 105 | ||||||

Vote Required for Approval

The election of Messrs. Holloway, Scaff, Peterson, Seward, Wilber, McElhaney, Conrad, NoffsingerAydin, Kelly and AydinKorus and Ms. Zucker to the Board will be approved if the number of votes cast in favor of“FOR” those candidates exceeds the number of votes cast for other candidates, if any. Abstentions and broker non-votes will have no effect on the outcome of the vote. Under our majority voting policy, any director nominee who receives a greater number of “WITHHOLD” votes than “FOR” votes with respect to their election is required to tender his or her resignation promptly after the final vote. See the description of our majority voting policy in “QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND PROCEDURAL MATTERS” above.

Board Recommendation

The Board recommends that you vote FOR“FOR” the election of Messrs. Holloway, Scaff, Peterson, Seward, Wilber, McElhaney, Conrad, NoffsingerAydin, Kelly and AydinKorus and Ms. Zucker as directors of the Company.

PROPOSAL NO. 2—RATIFICATIONAPPROVAL OF INDEPENDENT REGISTERED ACCOUNTING FIRMAMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE AUTHORIZED SHARES OF COMMON STOCK

The Company proposes to amend the Company’s Second Amended and Restated Articles of Incorporation (the “Articles”) to increase the number of authorized shares of our common stock, par value $0.001 per share, from 300,000,000 shares to 400,000,000 shares (the “Amendment”).

Rationale for Proposed Change

The Audit CommitteeArticles currently authorize us to issue 300,000,000 shares of common stock, of which [__] shares were issued and outstanding at the close of business on March 23, 2018. In addition, as of the same date, 4,500,000 shares of our common stock were reserved for issuance under outstanding equity compensation awards. If Proposal 3 is approved then based on the number of outstanding and reserved shares of common stock described above, as of March 23, 2018 we would have [__] shares of common stock remaining available for issuance for corporate purposes. The Board believes that this amount is undesirably low and that having additional authorized shares may be necessary for the Company to pursue its growth strategy. The increase in the number of authorized shares of common stock pursuant to the Amendment would enable the Company, without further shareholder approval, to issue shares from time to time as may be required for proper business purposes such as raising additional capital for ongoing operations, to complete acquisitions, to effect stock splits and dividends, to implement present and future employee benefit programs and for other corporate purposes.

Approval and Effectiveness

The Company proposes to effect the Amendment through the adoption of a Third Amended and Restated Articles of Incorporation. If approved, the Third Amended and Restated Articles of Incorporation will become effective upon filing with the Secretary of State of the State of Colorado. The proposed form of the Third Amended and Restated Articles of Incorporation is attached as Appendix B and is incorporated by reference in this Proxy Statement, which form is, however, subject to change as may be necessary or required by the Colorado Secretary of State.

The Board has selected EKS&H LLLP, an independent registered public accounting firm,unanimously approved the Third Amended and Restated Articles of Incorporation. The Board reserves the right, notwithstanding shareholder approval and without further action by the shareholders, not to auditproceed with the booksadoption of the Third Amended and recordsRestated Articles of Incorporation if, at any time prior to its filing with the Secretary of State of Colorado, the Board, in its sole discretion, determines that the changes reflected therein are no longer in the best interests of the Company for the fiscal year ending August 31, 2016 and the Company is submitting the appointment of EKS&H LLP to the shareholders for ratification. If the appointment is not ratified, the Audit Committee will reconsider its selection. A representative of EKS&H LLLP is expected to be present at the shareholders’ meeting and will have an opportunity to make a statement if he or she so desires, and will be available to respond to appropriate questions.

| 2015 | 2014 | |||||||

| Audit Fees | $ | 345,000 | $ | 275,000 | ||||

| Audit-Related Fees | 65,000 | 42,000 | ||||||

| Tax Fees | 91,000 | 66,000 | ||||||

| All Other Fees | 46,000 | 50,000 | ||||||

| Total Fees | $ | 547,000 | $ | 433,000 | ||||

Vote Required for Approval

The ratificationapproval of the appointmentamendment to our Second Amended and Restated Articles of EKS&H LLLP as our independent registered accounting firm for the year ended August 31, 2016Incorporation will be approved if the votes cast in favor of the proposal exceed the votes cast against it. Abstentions and broker non-votes will have no effect on the outcome of the vote.

Board Recommendation

The Board recommends that you vote FOR“FOR” the proposal to ratifyapprove the appointmentAmendment to increase the number of EKS&H LLLP asauthorized shares of our independent registered accounting firm for the year ended August 31, 2016.common stock, par value $0.001 per share, from 300,000,000 shares to 400,000,000 shares.

PROPOSAL NO. 3—APPROVAL OF SYNERGY RESOURCES CORPORATIONAMENDMENT TO 2015 EQUITY INCENTIVE PLAN

| Shares available for future grant | Shares issuable under outstanding awards | Average exercise price | Average remaining term | |||||||||

| 2011 Non-Qualified Stock Option Plan | 474,500 | 4,086,500 | $ | 9.41 | 8.1 years | |||||||

| 2011 Incentive Stock Option Plan | 2,000,000 | — | — | — | ||||||||

| 2011 Stock Bonus Plan | 649,437 | — | — | N/A | ||||||||

| Total | 3,123,937 | 4,086,500 | ||||||||||

Increase the maximum number of shares of common stock of the Company that may be issued pursuant to shareholder approval. Ifawards under the 2015 Plan is approved by our shareholders, it will become effective immediately and each of the 2011 Plans will terminate. Existing awards under the 2011 Plans will continue in accordance with their applicable terms and conditions.6,000,000 shares;

Make certain ministerial and housekeeping changes to the 2015 Plan.

Reasons for Adopting the Amended 2015 Plan

The Compensation Committee and the Board believe that in order to successfully attract and retain qualified and properly incentivized employees and directors in a highly competitive industry, we must continue to offer a competitive equity incentive program. Our 2015 Plan is approved by shareholders,the only equity incentive plan that we will have 4,500,000 commoncurrently maintain. As of December 31, 2017, there were only 110,158 shares authorized for grant pursuant to our equity compensation plans, taking into account the termination of the 2011 Plans. In setting the number of common shares authorizedremaining available for issuance under the 2015 Plan, we consideredand that number has decreased as a result of grants made in 2018. Accordingly, the potential dilution to our investors from awardsCompensation Committee and the Board believe that could be grantedthe shares available under the 2015 Plan. The 4,500,000 additional common shares authorized by theexisting 2015 Plan together with shares issuable pursuantare insufficient, and that it is critical to currently outstanding awards under the 2011 Plans, represent approximately 8.2% of the outstanding common shares as of October 19, 2015. We also considered the expected duration of the 2015 Plan. Duration is inherently uncertain because it involves estimates regarding a number of factors, including: (i) the number of common shares to be covered by awards to be granted, which changes with the number of recipients, their compensation levels and the fair market value of our common shares at the time of grant, (ii) with respect to performance-based awards that can vest below, at or above a target number of units based on performance goals, the actual number of units that will vest based on actual performance, and (iii) the rate of termination or forfeiture of awards that are made. Based on a number of assumptions regarding these matters, we currently estimate that the duration of the 2015 Plan will be between 4 and 6 years.

Description of the Amended 2015 Plan

The full textfollowing summary of material terms of the Amended 2015 Plan has been filed as an Appendix Adoes not purport to this proxy statement. The following description of the material features of the 2015 Planbe complete and is subject to and qualified in its entirety by reference to the textactual terms of the Amended 2015 Plan. A copy of the Amended 2015 Plan is provided as Appendix C to this Proxy Statement.

Purpose of the Amended 2015 Plan

The purpose of the Amended 2015 Plan is to promote the success of the Company and the interests of its stockholdersshareholders by providing an additional means for the Company to attract, motivate, retain and reward directors, officers, employees and other eligible persons (including certain consultants and advisors).

The Board or one or more committees consisting of independent directors appointed by the Board will administeradministers the Amended 2015 Plan. The Board will delegatedelegates general administrative authority for the Amended 2015 Plan to the Compensation Committee, which is comprised of directors who qualify as independent under rules promulgated by the SEC and the NYSE MKT.American. Except where prohibited by applicable law, a committee may

delegate some or all of its authority with respect to the Amended 2015 Plan to another committee of directors or to one or more officers of the Company. For purposes of Section 162(m) of the Internal Revenue Code of 1986 (the “Code”), Rule 16b-3 of the Exchange Act the rules of the NYSE MKTAmerican and for grants to non-employee directors, the Amended 2015 Plan must be administered by a committee consisting solely of two or more independent directors. The appropriate acting body, be it the Board, a committee within its delegated authority, or an officer within his or her delegated authority, is referred to in this plan description as the Administrator.

The Administrator has broad authority under the Amended 2015 Plan with respect to award grants including, without limitation, the authority:

| • | to select participants and determine the type(s) of award(s) that they are to receive; |

| • | to determine the number of shares that are to be subject to awards and the terms and conditions of awards, including the price (if any) to be paid for the shares or the award; |

| • | to cancel, modify, or waive the Company’s rights with respect to, or modify, discontinue, suspend, or terminate any or all outstanding awards, subject to any required consents, and subject to the repricing prohibition (described below); |

| • | to accelerate or extend the vesting or exercisability or extend the term of any or all outstanding awards subject to any required consent; |

| • | subject to the other provisions of the Amended 2015 Plan, to make certain adjustments to an outstanding award and to authorize the conversion, succession or substitution of an award; and |

| • | to allow the purchase price of an award or shares of the Company’s common stock to be paid in the form of cash, check, or electronic funds transfer, by the delivery of already-owned shares of the Company’s common stock or by a reduction of the number of shares deliverable pursuant to the award, by services rendered by the recipient of the award, by notice of third party payment or by cashless exercise, on such terms as the Administrator may authorize, or any other form permitted by law. |

Eligibility

Persons eligible to receive awards under the Amended 2015 Plan include officers and employees of the Company or any of its subsidiaries, directors of the Company, and certain consultants who render bona fide services to the Company or any of its subsidiaries (other than services in connection with the offering or sale of securities or as a market maker or promoter of securities of the Company). As of the date of this proxy,Proxy Statement, there are approximately 50134 employees, including officers, of the Company and sixfive non-employee directors of the Company who would potentially be eligible to receive awards under the Amended 2015 Plan.

Authorized Shares

The original number of shares of Company common stock that were authorized for issuance pursuant to awards under the 2015 Plan was 4,500,000, although as of December 31, 2017, there were only 110,158 shares remaining available for issuance under the 2015 Plan, and that number has decreased as a result of grants made in 2018. If the Amended 2015 Plan is approved, the maximum number of shares of Company common stock that may be issued pursuant to awards under the 2015 Plan is 4,500,000.plan will increase by 6,000,000. The Amended 2015 Plan generally provides that shares issued in connection with awards that are granted by or become obligations of the Company through the assumption of awards (or in substitution for awards) in connection with an acquisition of another Companycompany will not count against the shares available for issuance under the Amended 2015 Plan.Plan, except as may be required by the Administrator or applicable law or stock exchange rules.

Shares that are subject to or underlie awards which expire or for any reason are cancelled or terminated, are forfeited, fail to vest, or for any other reason are not paid or delivered under the Amended 2015 Plan will beare available for reissuance under the Amended 2015 Plan. Notwithstanding the foregoing, the Amended 2015 Plan prohibits liberal share recycling. Accordingly, shares tendered or withheld to satisfy the exercise price of options or tax withholding obligations, and shares covering the portion of exercised stock appreciation rights (or "SARs"“SARs”) (regardless of the number of shares actually delivered), will count against the limit set forth above. As of October 19, 2015, the closing price of our common stock as reported on the NYSE MKT was $11.16 per share.

Awards Under theAmended 2015 Plan

Because future awards under the 2015 Plan will beare granted in the discretion of the Board or a committee of the board, the type, number, recipients and other terms of future awards cannot be determined at this time.

No Repricing

In no case (except due to an adjustment to reflect a stock split or similar event or any repricing that may be approved by stockholders)shareholders) will any adjustment be made to a stock option or stock appreciation right award under the Amended 2015 Plan (by amendment, cancellation and regrant, exchange for other awards or cash or other means) that would constitute a repricing of the per share exercise or base price of the award.

Types of Awards

The Amended 2015 Plan authorizes stock options, stock appreciation rights, restricted stock, restricted stock units, stock bonuses and other forms of awards that may be granted or denominated in the Company’s common stock or units of the Company’s common stock, as well as cash bonus awards. The Amended 2015 Plan retains flexibility to offer competitive incentives and to tailor benefits to specific needs and circumstances. Awards may, in certain cases, be paid or settled in cash.

Stock Options

A stock option is the right to purchase shares of the Company’s common stock at a future date at a specified price per share (the “exercise price”). The per share exercise price of an option generally may not be less than the fair market value of a share of the Company’s common stock on the date of grant. On March 28, 2018, the last sale price of the Company’s common stock as reported on the NYSE American was $[__] per share. The maximum term of an option is ten years from the date of grant. An option may be either an incentive stock option or a nonqualified stock option. Incentive stock options are taxed differently than nonqualified stock options and are subject to more restrictive terms under the Code and the Amended 2015 Plan. Incentive stock options may be granted only to employees of the Company or a subsidiary.

Stock Appreciation Rights

A stock appreciation right is the right to receive payment of an amount equal to the excess of the fair market value of shares of the Company’s common stock on the date of exercise of the stock appreciation right over the base price of the stock appreciation right. The base price will beis established by the Administrator at the time of grant of the stock appreciation right and generally cannot be less than the fair market value of a share of the Company’s common stock on the date of grant. Stock appreciation rights may be granted in connection with other awards or independently. The maximum term of a stock appreciation right is ten years from the date of grant.

Restricted Stock

Shares of restricted stock are shares of the Company’s common stock that are subject to certain restrictions on sale, pledge, or other transfer by the recipient during a particular period of time (the “restricted period”). Subject to the restrictions provided in the applicable award agreement and the Amended 2015 Plan, a participant receiving restricted stock may have all of the rights of a stockholdershareholder as to such shares, including the right to vote and the right to receive dividends.

Restricted Stock Units

A restricted stock unit (“RSU”) represents the right to receive one share of the Company’s common stock on a specific future vesting or payment date. Subject to the restrictions provided in the applicable award agreement and the Amended 2015 Plan, a participant receiving RSUs has no stockholdershareholder rights until shares of common stock are issued to the participant. RSUs may be granted with dividend equivalent rights. RSUs may be settled in cash if so provided in the applicable award agreement.

Cash Awards

The Administrator, in its sole discretion, may grant cash awards, including without limitation, discretionary awards, awards based on objective or subjective performance criteria, and awards subject to other vesting criteria.

Other Awards

The other types of awards that may be granted under the Amended 2015 Plan include, without limitation, stock bonuses, performance stock, performance stock units, dividend equivalents, and similar rights to purchase or acquire shares of the Company’s common stock.

Performance-Based Awards

The 2015 Plan provided that the Administrator maycould grant awards that arewere intended to be performance-based compensation within the meaning of Section 162(m) of the Code (“Performance-Based Awards”). Pursuant to the Tax Cuts and Jobs Act, the exception to Section 162(m) of the Code for performance-based compensation has been eliminated, effectively meaning that no new Performance-Based Awards are in addition to any ofwill be issued under the other types of awards that may be grantedAmended 2015 Plan. However, existing Performance-Based Awards issued under the 2015 Plan (including options and stock appreciation rights which may alsocontinue to qualify as performance-based compensation, for Section 162(m) purposes). Performance-Based Awards may be inprovided that they are not materially modified. Accordingly, the form of restricted stock, performance stock, stock units, other rights, or cash bonus opportunities. The maximum aggregate number of shares that may be issued to any single participant pursuant to options and SARs underCompany has maintained the 2015 Plan will not exceed 4,500,000 shares of our common stock. The maximum aggregate number of shares that may be deliveredPlan’s provisions regarding Performance-Based Awards. Please refer to any single participant pursuant to other performance-based equity awards granted during in a single fiscal year within the 162(m) Term (as defined below) may not exceed 750,000 shares of our common stock, and the maximum amount of cash compensation payable pursuant to performance-based cash awards granted during a single fiscal year within the 162(m) Term may not exceed $3,000,000. The "162(m) Term" is the period beginning on the effective datetext of the Amended 2015 Plan and ending on the date of the first stockholder meeting that occurs in the fifth year following the year in which the Company’s stockholders approve the 2015 Plan. The foregoing limits have been included for tax compliance purposes and do not change the Company’s compensation philosophy,provided as described in the Compensation Discussion and Analysis portion ofAppendix C to this Proxy Statement. Accordingly, the Compensation Committee has no current intention of issuing awards of the size set forth herein, but believes that maintaining the flexibility afforded by the limits above is prudent.

The Administrator, in its sole and absolute discretion, may choose (in an award agreement or otherwise) to provide for full or partial accelerated vesting of any award upon a change in control, or upon any other event or other circumstance related to the change in control, such as an involuntary termination of employment occurring after such change in control, as the Administrator may determine. Notwithstanding the foregoing, in the event the Administrator does not make appropriate provision for the substitution, assumption, exchange or other continuation of the award pursuant to the change in control, then each then-outstanding option and

stock appreciation right shall automatically become fully vested, all shares of restricted stock and restricted stock units then outstanding shall automatically fully vest free of restrictions, and each other award granted under the Amended 2015 Plan that is then outstanding shall automatically become vested in full (assuming all performance targets have been achieved at 100% of target) and payable to the holder of such award.

For purposes of the Amended 2015 Plan, a "change“change in control"control” will be deemed to have occurred if:

(a) The acquisition by any individual, entity or group of beneficial ownership of more than 50% or more of the combined voting power of the then outstanding voting securities of the Company entitled to vote generally in the election of directors, subject to certain exceptions;

(b) Individuals who, as of the effective date of the Amended 2015 Plan, constitute the Board cease for any reason to constitute at least a majority of the Board; provided, however, that any individual becoming a director subsequent to the effective date of the Amended 2015 Plan whose election, or nomination for election by the Company’s stockholders,shareholders, was approved by a vote of at least two-thirds of the directors then comprising the incumbent Board (including for these purposes, the new members whose election or nomination was so approved, without counting the member and his predecessor twice) shall be considered as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a person other than the Board;

(c) Consummation of a reorganization, merger, statutory share exchange or consolidation or similar corporate transaction involving the Company, a sale or other disposition of all or substantially all of the assets of the Company, or the acquisition of assets or stock of another entity by the Company, in each case unless, following such transaction, (1) all or substantially all of the individuals and entities that were the beneficial owners of the outstanding voting securities of the Company immediately prior to the transaction beneficially own, directly or indirectly, more than 50% of the the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the entity resulting from the transaction, (2) no person beneficially owns, directly or indirectly, more than 50% of, respectively, the combined voting power of the then-outstanding voting securities of the entity resulting from the transaction, except to the extent that the ownership in excess of more than 50% existed prior to the transaction, and (3) at least a majority of the members of the board of directors or trustees of the entity resulting from the transaction were members of the Board at the time of the execution

of the initial agreement or of the action of the Board providing for the transaction; or

(d) Approval by the stockholdersshareholders of the Company of a complete liquidation or dissolution of the Company other than in the context of a transaction that does not constitute a change of control under (c) above.

Notwithstanding the foregoing, a change in control shall not be deemed to have occurred by virtue of the consummation of any transaction or series of integrated transactions immediately following which the holders of the Company’s voting securities immediately prior to such transaction or series of transactions continue to have substantially the same proportionate ownership in an entity which owns all or substantially all of the assets of the Company immediately following such transaction or series of transactions. No compensation that has been deferred for purposes of Section 409A of the Code shall be payable as a result of a change in control unless the change in control qualifies as a change in ownership or effective control of the Company within the meaning of Section 409A of the Code.

Transferability of Awards

Awards under the Amended 2015 Plan generally are not transferable by the recipient other than by will or the laws of descent and distribution, or pursuant to domestic relations orders, and with respect to awards with exercise features, are generally exercisable during the recipient’s lifetime only by the recipient. Any amounts payable or shares issuable pursuant to an award generally will be paid only to the recipient or the recipient’s beneficiary or representative. The Administrator has discretion, however, to establish written conditions and procedures for the transfer of awards to other persons or entities, as long as such transfers comply with applicable federal and state securities laws and provided that any such transfers are not for consideration.

Adjustments

As is customary in plans of this nature, the share limit and the number and kind of shares available under the Amended 2015 Plan and any outstanding awards, as well as the exercise or purchase prices of awards, and performance targets under certain types of Performance-Based Awards, are subject to adjustment in the event of certain reorganizations, mergers, combinations, recapitalizations, stock splits, stock dividends, or other similar events that change the number or kind of shares outstanding, and extraordinary dividends or distributions of property to the stockholders.shareholders.

No Limit on Other Authority

The Amended 2015 Plan does not limit the authority of the Board or any committee to grant awards or authorize any other compensation, with or without reference to the Company’s common stock, under any other plan or authority.

Non-Competition, Code of Ethics and Clawback Policy

By accepting awards and as a condition to the exercise of awards and the enjoyment of any benefits of the Amended 2015 Plan, each participant agrees to be bound by and subject to non-competition, confidentiality and invention ownership agreements acceptable to the Administrator and the Company’s code of ethics and other policies applicable to such participant as is in effect from time to time. Awards are subject to any clawback policy adopted by the Company from time to time.

Awards to Directors